Kijun Times

Kijun Times 는 교내 영어잡지,신문 동아리로 다양한 주제에 관한 이슈로 원고를 작성하며 영어 잡지를 만드는 동아리입니다.

매년 잡지 출판뿐만 아니라 자신의 진로와 관련된 개인기사, 모둠기사를 작성함으로써 영어 실력향상은 물론 주제에 제한이 없기 때문에 다양한 진로에 접목 가능합니다.

We are looking for a new journalist for The KIJUN TIMES.

Anyone can be a journalist for The KIJUN TIMES.

Draghi ready to throw more money at Europe's economy |

|||||

|---|---|---|---|---|---|

| 이름 | 김효진 | 등록일 | 15.10.23 | 조회수 | 814 |

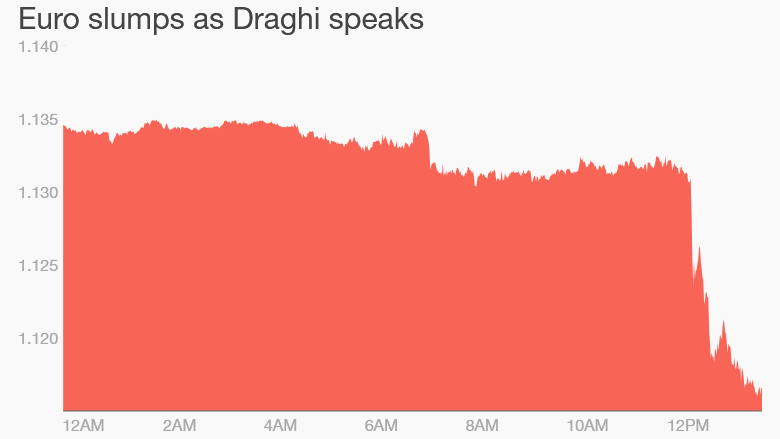

Europe's top central banker Mario Draghi could give markets an early Christmas present.The president of the European Central Bank said Thursday that the bank was examining new ways to tackle deflation and get the economy moving again, and could act as early as its next meeting on Dec. 3. Steps the ECB could take in six weeks' time include cutting interest rates on deposits even deeper into negative territory, or increasing the size and scope of its program of quantitative easing -- printing money to buy government bonds and other assets. "Further lowering of the deposit facility rate was discussed. It is one of the instruments... that I referred to when I said all instruments had been discussed," said Draghi. "There was no explicit preference towards one instrument or another, all of them were considered." He was speaking after the central bank decided to leave interest rates unchanged, and to keep buying assets at a rate of 60 billion euros ($67 billion) a month at least until September 2016. "Our approach at today's meeting was not wait and see, but work and assess," he said at a news conference. A few members of the bank's governing council had hinted at "the possibility of acting today" but it wasn't seriously discussed, Draghi added. The ECB wanted to conduct a more thorough analysis of the factors that are depressing prices before acting again. Draghi is clearly worried about the impact of a prolonged period of very low inflation, and a sharp slowdown in emerging markets, on the fragile European recovery. Related: China slowdown is already hurting Europe Investors took Draghi's statement as a strong signal to sell the euro, sending it down by about 1.5% against the dollar to new daily lows.  "Moving forward, the euro may be exposed to more downwards pressure as investors increase bets on more quantitative easing," noted FXTM research analyst Lukman Otunuga. European stock markets cheered, with the main indexes in Germany and France gaining 2%. |

|||||

| 이전글 | School recognized for extended-care programs |

|---|---|

| 다음글 | China slashes interest rates again |